1099 Instructions

What is the process for eFiling my 1099s and 1096 in Sage 50? Sage 50 Version 2020.0 and older click here

| STEP-BY-STEP INSTRUCTIONS |

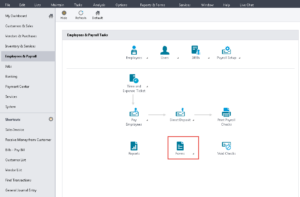

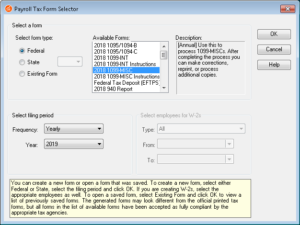

1. Open the Federal Forms List |

|

Under "Employees & Payroll", click the "Forms" button and select "Federal Forms (W-2, 940, etc.)".

|

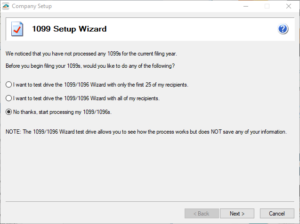

2. Review Company Information. |

A company setup wizard will take you through your company information that will display on the 1099/1096 forms. All or most of the information will be populated from Sage 50. |

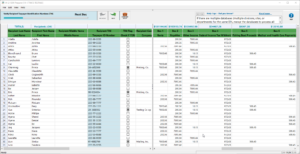

3. Review Recipient Information. |

The wizard will take you into a grid displaying all of your recipient data to review. Several data validations are performed during this step to ensure accuracy of your recipient data and help elimination rejections. |

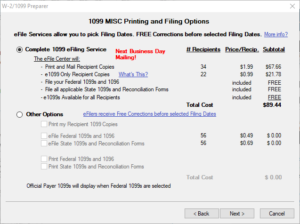

4. Select Your Filing Options. |

The complete eFile package is the best value but you can also eFile just your Federal and or State 1099/1096s as well as print all your 1099s copies. |

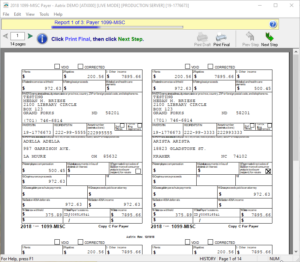

5. Review Your Forms. |

A Form Viewer will display your forms for review. You can print a record copy if eFiling or your official copy if printing and mailing. |

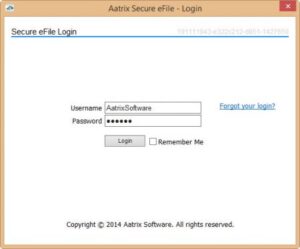

6. Submit Your Forms. |

An eFile wizard will guide you through submitting your forms to the eFile Center. Enrollment to the eFile center is required to obtain a username and password, click here to enroll now or you can enroll at time of eFiling. |