W2 Instructions

| STEP-BY-STEP INSTRUCTIONS |

1. Select the W-2 Form. |

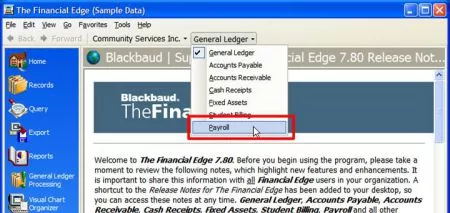

| Select "Payroll" under the second drop down list.

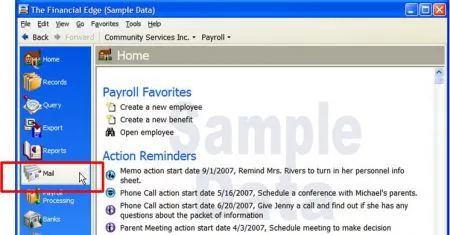

Click the "Mail" button.

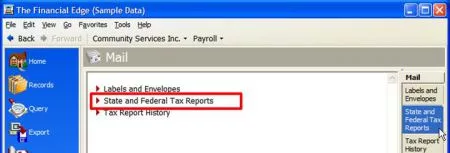

Click the "State and Federal Tax Reports" option.

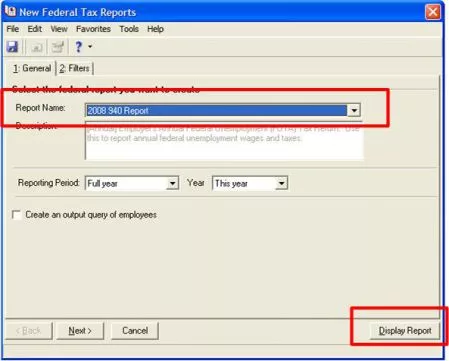

On the State and Federal Tax Reports dialog, click the "New" button which brings up a forms selection window. Select "W-2 SSA" from the drop down list and click the "Display Report" button.

|

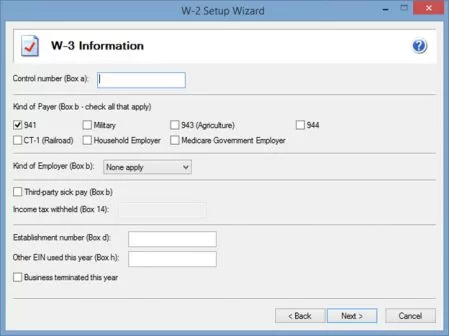

2. Review Company Information. |

A company setup wizard will take you through your company information that will display on the W-2/W-3 forms. All or most of the information will be populated from Blackbaud. |

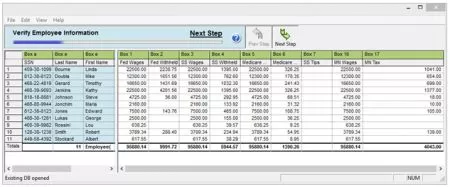

3. Review Employee Information. |

The wizard will take you into a grid displaying all of your employee data to review. Several data validations are performed during this step to ensure accuracy of your employee data and help elimination rejections. |

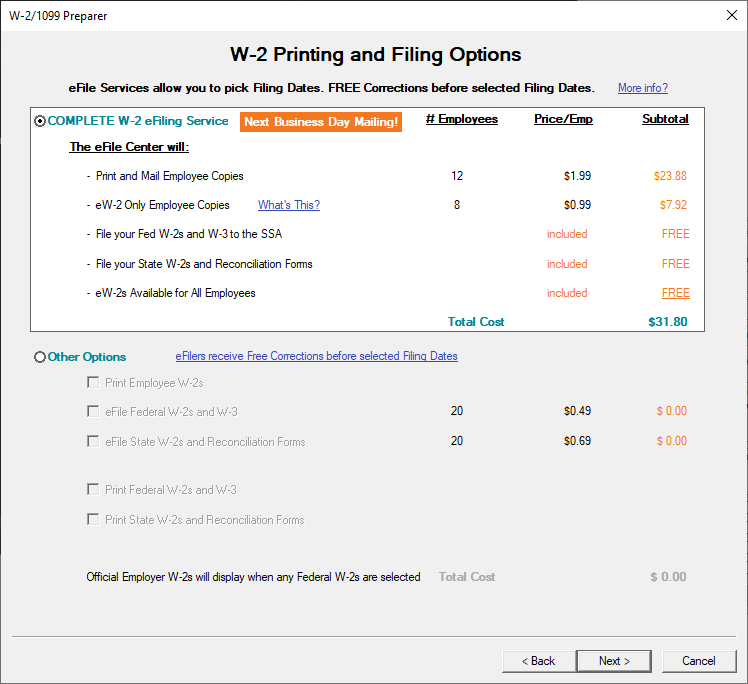

4. Select Your Filing Options. |

The complete eFile package is the best value but you can also eFile just your Federal and or State W-2s/W-3s as well as print all your W-2 copies. |

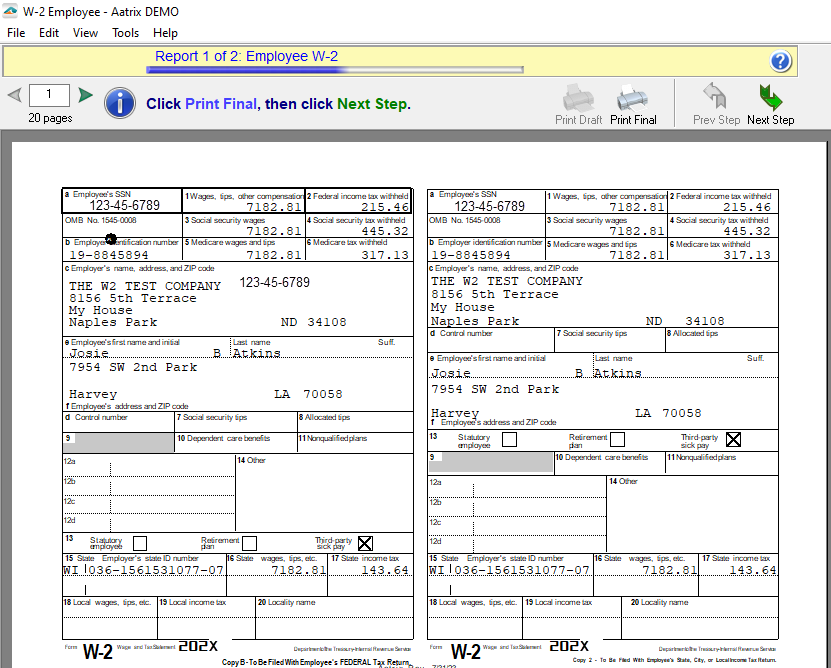

5. Review Your Forms. |

A Form Viewer will display your forms for review. You can print a record copy if eFiling or your official copy if printing and mailing. |

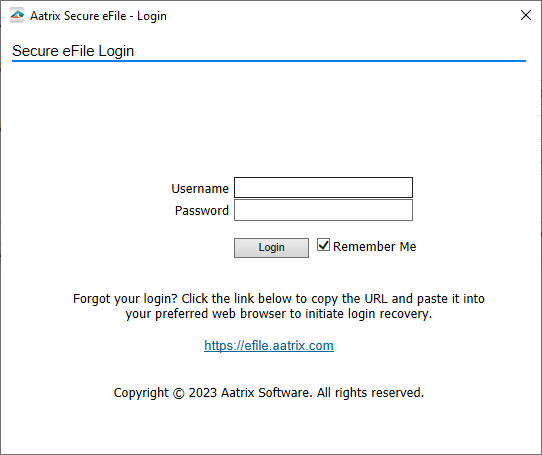

6. Submit Your Forms. |

An eFile wizard will guide you through submitting your forms to the eFile Center. Enrollment to the eFile center is required to obtain a username and password, click here to enroll now or you can enroll at time of eFiling. |