1099 Instructions

| STEP-BY-STEP 1099 INSTRUCTIONS |

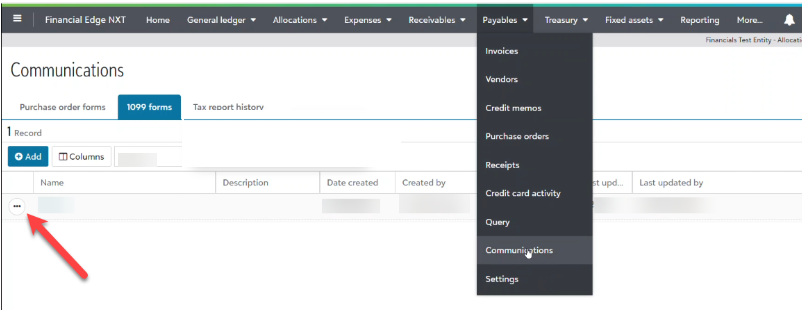

1. Go to payables -> Communications -> 1099 Forms |

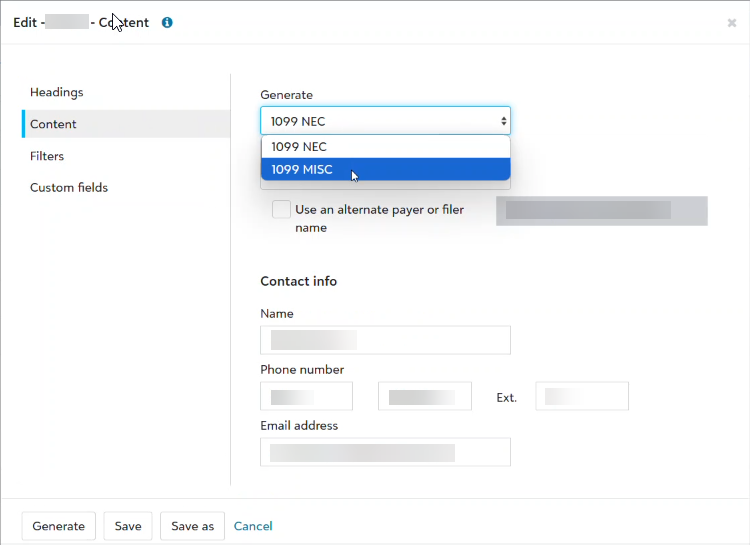

| From Payables and Communications, under 1099 forms, you can view, add, edit, and generate. Search or sort the list to quickly locate the form you want. To Edit an existing form, select the form's name or choose "edit" from the forms menu.

|

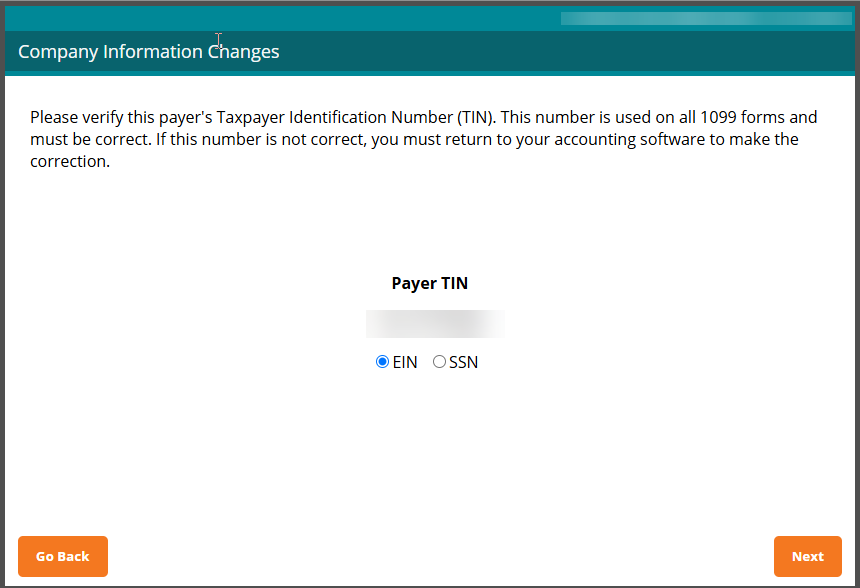

2. Review Company Information. |

A company setup wizard will take you through your company information that will display on the 1099/1096 forms. All or most of the information will be populated from Blackbaud. |

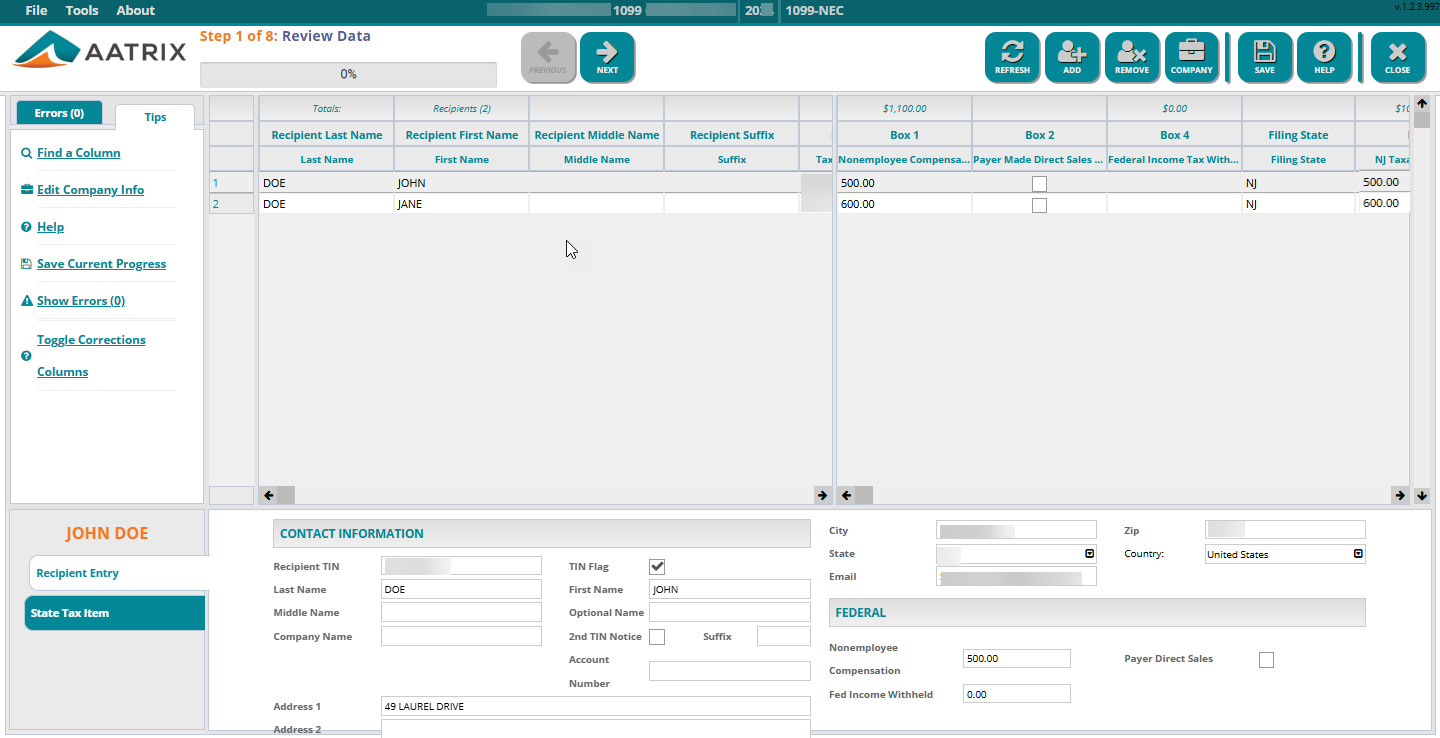

3. Review Employee Information. |

The wizard will take you into a grid displaying all of your employee data to review. Several data validations are performed during this step to ensure the accuracy of your employee data and help eliminate rejections. |

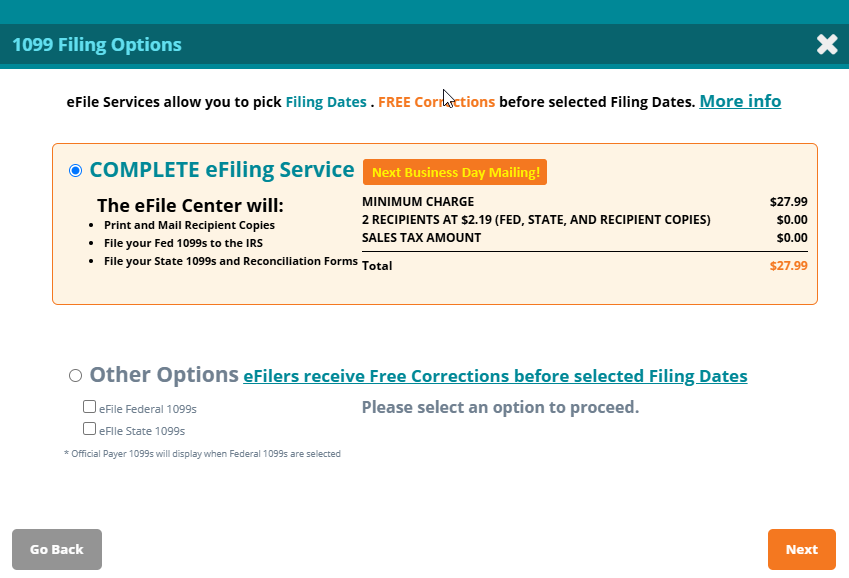

4. Select Your Filing Options. |

The Complete eFile package is the best value and includes printing and mailing your vendor/recipient copies. However, you can also eFile just your Federal 1099s/1096 and/or State 1099s/1096 or Reconciliation forms (if required). |

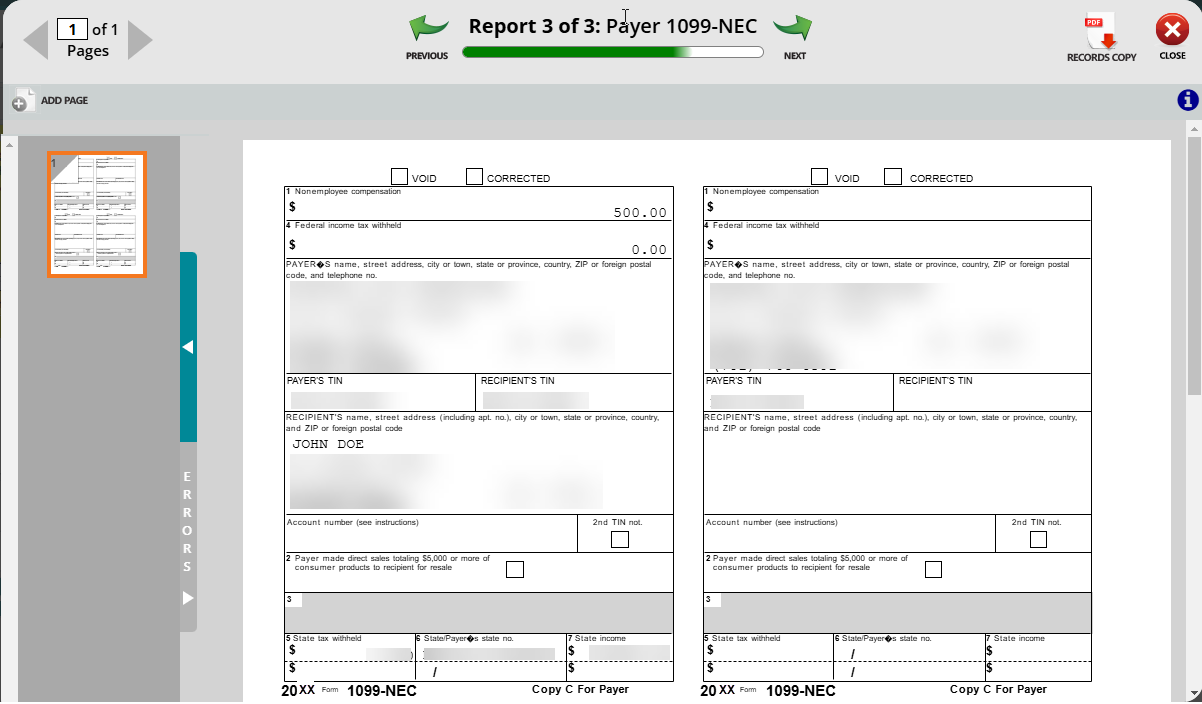

5. Review Your Forms. |

A Form Viewer will display your forms for review. You can download a record copy of each form. |

6. Submit Your Forms. |

| An eFile wizard will guide you through submitting your forms to the eFile Center. You'll receive an AFID (Aatrix Filing ID) at the end of the process, once you click submit. You will also receive an email confirmation to the email address on file.

How To Access Your Work-in-Progress or History From Payables -> Communications under Tax report history, use your Aatrix credentials to log in and select your draft or history. |